Welcome to the Market Framework Model (MFM)

A structural way to read markets

Markets generate noise. Indicators disagree. Structure gets lost.

MFM brings structure back by showing only what matters:

The state of the market across four consistent layers.

MFM is not a trading system, not a signal generator, and not a performance model.

It is a structural interpretation framework designed to reveal when markets are coherent and when they are not.

Protected via BOIP i-Depot #155670. Educational use only.

Most tools show signals. None show structure.

Traders drown in indicators. One signal says “buy”, another says “sell”.

Charts become noisy. Important context disappears.

What traders actually need is not more signals, but a way to understand the environment they are trading in.

Structure first, signals second.

That’s where MFM begins.

No clutter. No overfitting. No noise.

Just context.

A single, coherent framework for market context.

The Market Framework Model organizes the market into four structural layers.

Each layer shows a different dimension of market behavior, without clutter or noise.

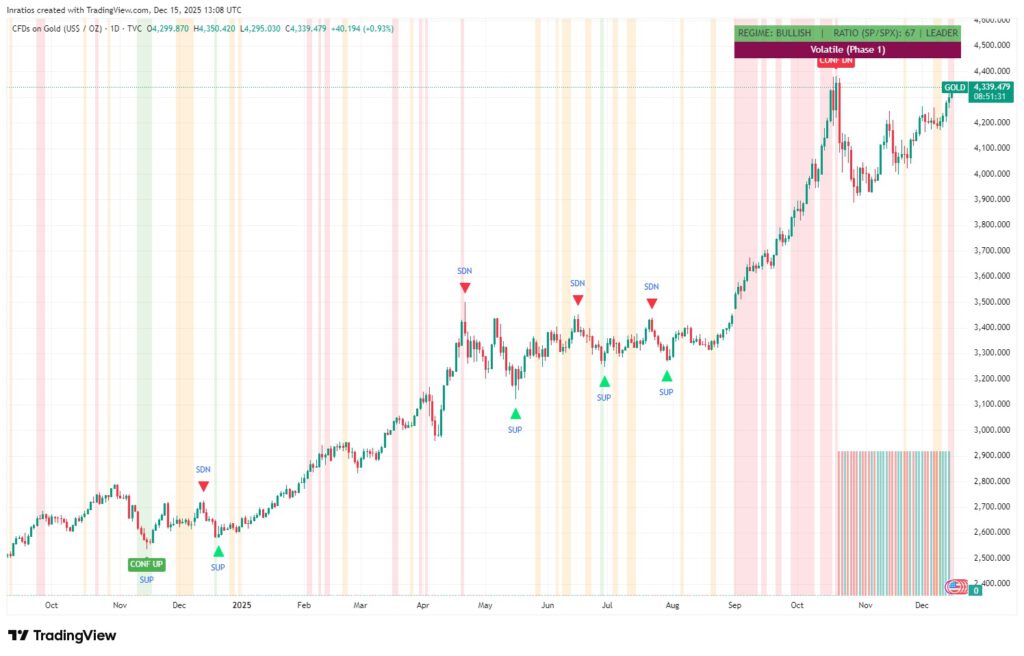

The model organizes the market into four layers:

- Regime: the broader environment behind price

- Phase: the momentum rotation cycle

- Leadership: relative strength vs. benchmark

- Directional Probability: short-term structural setups

Structure emerges when all four layers align.

Most traders don’t fail because they lack signals.

They fail because they lack structure.

MFM helps traders:

- Avoid trading during unstable phases

- Understand whether strength or weakness is supported

- See when internal momentum aligns with the environment

- Interpret markets consistently across all assets and timeframes

- Focus on structure instead of reacting to noise

MFM does not predict.

It organizes.

Different assets, same structural behavior.

Across assets with completely different volatility profiles (BTC, XRP, NVDA, SPX, Gold) the same structural tendencies appeared:

- Phase 3 showed the strongest forward structure

- Phase 2 behaved like neutral compression

- Phase 1 reflected exhaustion and dispersion

- Leadership refined these dynamics

- Regime shaped how phases played out

The takeaway is not performance.

It’s repeatability: the structural behavior was consistent across markets.

Built for traders who prefer clarity over noise.

- Clarity rather than signal overload

- Structure rather than noise

- A clean chart

- A repeatable method

- Consistent logic across any asset or timeframe

If you value context, MFM fits your workflow.

Learn how to read the model.

The user guide explains how to read the regime, phases, leadership, and pattern context in a clear, non-technical way.

Disclaimer

The Market Framework Model (MFM) and all related materials are provided for educational and informational purposes only. They do not constitute financial advice, investment recommendations, or trading signals. MFM describes structural market context, not future outcomes.

Any examples, visualizations, or backtests are illustrative, based on historical data only, and do not imply or guarantee future performance.Financial markets involve risk, including the potential loss of capital. All decisions remain the sole responsibility of the user.

MFM should not be used as the sole basis for trading or investment actions. The author and Inratios© make no representations or warranties regarding the accuracy, completeness, or reliability of the information provided.By using the Market Framework Model or any related insights, you acknowledge and accept these terms.

© 2025 Inratios. Market Framework Model (MFM) is protected via i-Depot (BOIP) – Ref. 155670. No financial advice.